It's hard to imagine where the retail garden industry would be without families. In Garden Center’s 2017 State of the Industry Report, 92 percent of independent garden center owners and operators surveyed indicated they are family-owned businesses, with 48 percent of those reporting to be second-generation owners.

Relatives, working together to keep an inherited business going, is such a common thread in the business of garden retail that many IGC owners plan to pass the torch to their own children upon their retirement. This makes it all the more challenging when first, second or third-generation owners find out the next generation is unavailable or unable to take the reins.

Succession planning is often cited by IGC retailers as one of the more daunting and challenging aspects of long-term business operations. In Garden Center’s 2017 SOI report, 48 percent of respondents answered “no” when asked if they have a succession plan in place. In the event their children aren’t available or willing to inherit the business, many independent retailers are left searching for a suitable buyer.

That was the case for Charbel and Ruth Harb, who had owned Harb’s Oasis, a garden center and landscape company in Baton Rouge, La., for more than 35 years.

“When we realized not one of our highly educated children were going to run the garden center and landscape company that we owned for over 35 years, we started looking at different options,” Charbel says.

The Harbs considered an employee ownership model, but when that proved unfeasible, it was time to step onto the open market, where the real challenges began. [Editor’s note: Read our January cover story for more on employee ownership models at bit.ly/2BWeYy5]

Playing the field

When some businesses start looking for a buyer, one of the first things they do is set up a “for sale” sign in front of the building. Charbel says he and Ruth started by hiring a business broker and advertising their sale on regional business-for-sale websites. The broker helped them navigate the commercial property landscape and organize interested buyers, but the early crop of candidates didn’t exactly impress.

“We soon found out that selling a garden center with a landscape business on the open market is not a cake walk,” Charbel says. “The buyers we found were financially unqualified, or they had no knowledge in our industry, or [there were] some that know plants [but] lacked common business sense.”

Some retailers have a more difficult time in this process than others. Kim Redman, owner of Sassafrass Garden & Gifts in Lake City, Mich., has owned her IGC since 2012 and put it on the market earlier this summer, with hopes to retire if a buyer is found. Redman says Lake City, which relies heavily on seasonal tourism for its economy, is short on qualified business buyers.

“In Lake City, there are a lot of businesses going out, there are empty buildings,” Redman says. “It’s very hard to sell a business [here]. We’re a tourist town, so we get mostly just seasonal [business]. There’s a lake here for cottages and houses, it’s a great market, but businesses have a kind of tough [time]. Finding the right person is tough.”

During the search for a buyer, it’s helpful to attract a large quantity of applicants, but the even the largest candidate pool does little good if quality is lacking. Management consultant John Kennedy, a service provider with the Garden Center Group, says that if an owner wishes to sell, there are steps they can take to make sure their business is profitable, desirable and has a dependable staff to make it all work — while communicating those qualities to potentially interested parties.

“If I was a buyer of anything, I would want to make sure it was built to last, that there are systems in place, there are financial reportables, there’s profitability over a consistent period of time,” Kennedy says. “Do I have the right leadership team at the helm? Because I’m buying the business, and part of that business is that strong team. The human value of an organization beyond the financial value of the organization is probably, to some degree, a percentage of the value of the business.”

Not only did the Harbs plan to keep their employees on board throughout the retirement and transition process, but they also intended to be involved with the new owners for onboarding and to bridge the gap between existing staff and new leadership. Kennedy says this is an important factor to consider in any business transaction — when staff feel disillusioned with new ownership, the future of the business is at stake.

Kennedy tells the story of a client he worked with previously who, after selling the business, stayed on for the next three years and was paid off gradually by the new owners. When the prior owner departed, a smooth and organic transition had been accomplished.

“By that point, it wasn’t a surprise. A lot of employees realized that they’d slowly been integrated with the new management team,” Kennedy says of his example. “The new management had time to build rapport and respect and connection so that final thread that was pulled wasn’t like cutting a rope. The people buying [the business] were smart enough to know the value of the folks that were running it to begin with.”

The Harbs would find value in this process themselves when they eventually settled on suitable buyers — although finding buyers took some outside-the-box thinking.

The right fit

Choosing a buyer is not a decision to take likely. The Harbs understood that the new owners of Harb’s Oasis needed to be both passionate and competent, and thusly turned down potential buyers they weren’t confident in. Redman agrees that the task of running her business calls for a person (or ideally, a couple or team of people) invested in seeing Sassafrass Garden & Gift grow.

“I would hope that [the business] would flourish the way it is, because it has evolved on its own, and I would hope that it would get better and better [under a new owner]. There’s a lot of possibility here, it just has to be the right person,” Redman says. “Not saying I’m not the right person. I’m just trying to do a lot of it myself, and it really needs to be a couple or a team to help each other through this. It has to be somebody that’s very passionate and wants to follow their passion.”

After combing through a long list of applicants and coming up empty, the Harbs decided to do the unexpected and go directly to their clients and loyal customers to gauge their interest in owning Harb’s Oasis.

“We decided that our clients would be our best hope,” Charbel says. “They were affluent, loved gardening and had the resources to buy our business. So we started talking to many long-term clients about the nursery being available for sale and that my wife and I and our employees would guide them and make them prosperous.”

The Harbs crafted their sales pitch to appeal to their clients, making it clear that they would retire but continue to own the land, and would pass on the existing employees and business model to the next owners.

At the same time, they trimmed down on unnecessary inventory to make the business leaner and more affordable for the prospective buyers Charbel and Ruth were in talks with.

“In this plan, we kept all fixtures, office furniture, registers, leased equipment, company-owned trucks, trailers, Bobcat, forklift and business equipment,” Charbel says. “Merchant services, utilities, insurance, and service leases would remain in effect, plus whatever inventory we did not sell would be available for the new buyers to be able to take over and continue the business immediately.”

... we started talking to many long-term clients about the nursery being available for sale and that my wife and I and our employees would guide them and make them prosperous." — Charbel Harb, former co-owner of Harb’s Oasis

This process called for what is known as a liquidation sale, so the Harbs hired a retirement sale specialist to help organize the inventory reduction. The specialist recommended a mid-week sale, guided Charbel and Ruth through the different ad campaigns and press releases they needed and cautioned them to “pray for good weather,” according to Charbel.

“The Wednesday came Oct. 11, 2017, on a beautiful, sunny day and the people came in droves and poured in,” he says. “We realized that being in business for 38 years meant something to our clients, as well as the discounts! We did not have enough registers, and people had to wait in line over 30 minutes, yet they visited with us and reminisced about the Harbs and their retirement. We got lots of hugs that day, it was a very emotional experience for us.

“The people kept coming Thursday, Friday, Saturday and Sunday in droves, less than Wednesday, but sales were still very strong,” Charbel adds. “We kept going for three weeks and sold as much as we could. Our landscape department was still going on. We must have mentioned over a thousand times to our clientele that our business would continue with their favorite employees still working here.”

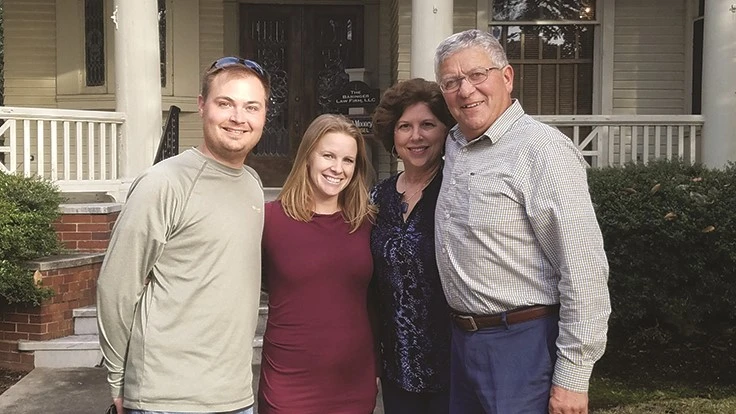

Meanwhile, a young couple, Jerry and Lindsey All, who were regular clients of Harb’s Oasis, were establishing themselves as strong candidates for succession of the business.

“They had no plant or retail experience, but they were business savvy and very professional in their approach,” Charbel says. “They also [kept] the well-known name ‘Harb’s Oasis,’ the telephone number, website, email address and all our customer base emails as part of the deal.”

After roughly three years on the market, Harb’s Oasis was sold to the Alls on Jan. 16, 2018. As part of the sale agreement, the Harbs remained involved in the day-to-day operations through the following months to ensure Jerry and Lindsey were confident in running the business on their own.

“We stayed on as consultants for a period of time to help with spring ordering, bookings, sources, landscape sales, displays and advertising,” Charbel says. “After Mother’s Day, we were able to step aside and, with the help of our faithful employees, they were able to be on their own.” [Editor’s note: The Alls could not be reached for comment.]

For businesses going through an ownership transition, Kennedy stresses that the process should be given the time it needs, but conflicts can arise if outgoing leaders take too long to cut the cord.

“It’s messy and muddy, and there’s no right answer because every business has a different personality to it and a different sense of energy in employees and how they interact,” Kennedy says.

Understand the options

Family inheritance is especially common among garden center succession planning, but many IGC owners have found themselves in situations similar to that of Harb’s Oasis — the next generation isn’t always an option, as much as their parents might wish for them to follow in their footsteps.

Kennedy suggests that keeping the business in the family may not always be the best option, even when the kids are interested in taking over. Family connections are deep, but being a relative of the current owner shouldn’t be the only qualification for succession.

“Some of [the next generation] aren’t interested. Some of them were born on third base and want to convince you they hit a triple,” Kennedy says. “Some just very well may not be the right person [for the position], although they believe they are and think they’ve earned the right as a member of the family.”

One option that Kennedy recommends to simplify succession planning is installing a board of directors. Long-time managers and other senior staff can serve as directors of a business, selecting the most qualified and capable person for the ownership position — whether they’re in the family or not.

“There is wisdom in, probably five years out [from retirement], creating a board of directors that can help take the personal element out and put the professional element in to guide, steer and facilitate the change, so that any final decisions are in the best interest of the company and the employees and not so specific to the family,” Kennedy says.

Another alternative to simply selling a business or passing it onto family members is to “break out” specific departments or services within the garden center, empowering managers to run them independently, while paying the owner a share of the profits. Kennedy suggests that a pottery or container department, for instance, could be run as a pop-up in an open market setting. He cites the North Market in Columbus, Ohio, Urban Space in New York City and Pine Street Market in Portland, Ore., as examples of smaller, independent operations sharing a market space.

This practice of turning employees into owner-operators of their own departments is being embraced in other industries, including salon stylists and cosmetologists. Kennedy says that by piecing out their brand into smaller, more independently-run settings, garden center owners can expand their brand, secure a form of continuity for their business and raise up a potential future owner in the process.

“Now, all the sudden, I’ve taken apart my garden center; I haven’t really sold it, but I’ve re-purposed it in a more independent way,” Kennedy says. “I see these as market shifts that may very well find a spot in the green industry.”

Plan, but don’t forget to execute

When it comes to selling a business, the right time to start planning is five years ago. Kennedy says it’s crucial for business owners to keep careful and consistent financial records so they can accurately prove their long-term profitability to prospective buyers.

Redman, who decided to pursue a plan to sell her IGC relatively recently, has made a renewed commitment to accurate and thorough bookkeeping.

“I am planning, in three years, to get this place sold. I expect it to take time, and I’m trying to keep my ducks in a row for this process more than I have in the past. In the past, I wasn’t really seriously thinking [about selling] because I loved it so much,” she says. “I’m working harder at that. Think ahead of when you want to [sell] and give yourself some time, because it’s going to take time ... and keep your reports straight.”

Kennedy also highly recommends working with a business broker who can help seek out buyers, screen offers and prepare a company for a changing of hands.

“[Brokers] come in and do an evaluation of the business — just like a home appraisal,” Kennedy says. “As there are [real estate agents] to sell your home, there’s the equivalent of that in the commercial business world for somebody to help you sell your business.”... if there’s a time in the next year or two to get your ducks in a row and really make yourself [attractive to buyers], it would be now. — MANAGEMENT CONSULTANT JOHN KENNEDY, a service provider with the Garden Center Group

As far as current opportunities to sell, Kennedy says the economic climate is encouraging investment activity across the country.

“There are a lot of folks who are cash-heavy right now because of the tax breaks. They’re sitting on a ton of money and their interest is ‘how can I invest it?’ There are a heck of a lot of mergers, acquisitions and purchases happening,” he says. “So, if there’s a time in the next year or two to get your ducks in a row and really make yourself [attractive to buyers], it would be now. An economic recession is inevitable, and you don’t want to try and sell something on the way down. You want to sell it at the height.”

In other words, it’s best to get moving on a business transaction while the getting is good, as long as you can demonstrate strong financials. Planning thoroughly is important, but Kennedy cautions owners not to think so hard that they forget to start courting buyers.

“If you keep thinking about it, you’re going to miss this opportunity,” he says. “Now is the time most organizations are cash-heavy and have a lot of assets available. Maybe an independent garden center might be something they’d want to think about. Stop thinking and do.”

Explore the August 2018 Issue

Check out more from this issue and find your next story to read.

Latest from Garden Center

- Leading Women of Horticulture: Emily Showalter, Willoway Nurseries

- Garden Center 2025 Top 100 IGCs List open for submissions with new judging criteria

- Meet the All-America Selections AAS winners for 2025

- AmericanHort urges exclusion of sphagnum peat moss from proposed Canadian tariff

- VIDEO: Garden Center's 2024 State of the Industry Report

- The Growth Industry Episode 2: Emily Showalter on how Willoway Nurseries transformed its business

- Farwest Show calls for 2025 New Varieties Showcase entries

- Oregon Nurseries Hall of Fame member Jack Bigej passes away